GoalPath Fi360 Funds

Portfolio construction and rebalancing that leverages Fiduciary Score®

Talk to Us

Making fiduciary review and rebalancing scalable for retirement plan advisors

A rigorous, evidence-based selection process with quantitative and qualitative review

New “best practices” open architecture QDIA solutions with multiple glidepaths

Overview of the Fund Series

GoalPath Fi360 Funds are designed to manage risks that face retirement plan investors when it comes to replacing their income. The Funds take into account the transfer of human capital (current and future earnings power) to financial capital (retirement savings) over time. As retirement approaches, the Funds recognize this shifting risk and gradually change their asset allocation, holding more growth-focused assets (stocks and bonds) when an investor is many years away and more inflation protected hedged income securities (TIPS) as the target retirement date approaches.

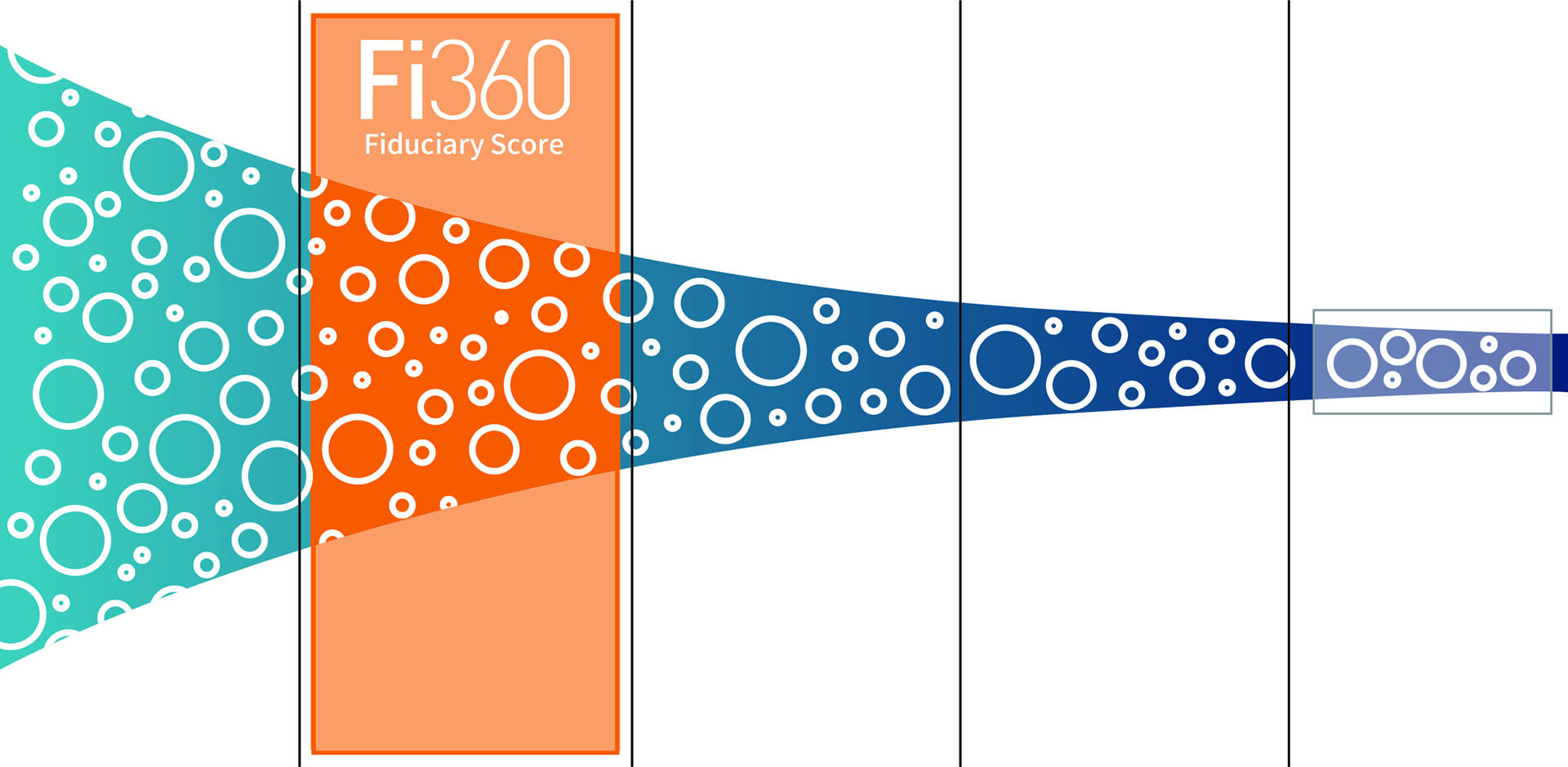

The Fi360 Fiduciary Score®

The Fi360 Fiduciary Score is a peer percentile ranking of an investment against a set of quantitative due diligence criteria selected to reflect prudent fiduciary management. The Fi360 Fiduciary Score is calculated on a monthly basis for investments with at least a three-year history. The score is calculated for open-end mutual funds, exchange-traded funds, collective investment trust funds, and group retirement plan annuities.

Investment Selection Process

An Evidence-Based Approach

Our Academic Review Committee’s investment selection process combines robust academic research, Modern Portfolio Theory, rigorous testing and thorough peer review to select the investment lineup.

Initial Universe

of 20,000+

Funds

GoalPath Proprietary Quantitative Assessment

GoalPath Qualitative Review

Evidence-Based Fund Lineup

Fees

MPT Statistics

Style Consistency

Tracking error

Diversification by holdings

Risk / Return Assessment

Attribution analysis to confirm returns consistent with academic evidence

Management Conversations

Firm Assessment

Investment Philosophy

Legal / Regulatory Issues

Ownership

Other Relevant Factors

Initial Universe of 20,000+ Funds

GoalPath Proprietary Quantitative Assessment

GoalPath Qualitative Review

Evidence-Based Fund Lineup

Management Conversations

Firm Assessment

Investment Philosophy

Legal / Regulatory Issues

Ownership

Other Relevant Factors

Fees

MPT Statistics

Style Consistency

Tracking error

Diversification by holdings

Risk / Return Assessment

Attribution analysis to confirm returns consistent with academic evidence

Questions. Answers.

What’s the advantage of including Fi360’s Scores as a fund selection factor within GoalPath’s strategies?

Including Fi360 Scores as a criteria within GoalPath’s fund selection process ‘builds-in’ scalable fiduciary reviews and rebalancing for advisors who select these strategies. This is a great example of technology driving efficiencies in fiduciary account management.

What’s the relationship between GoalPath and Fi360?

GoalPath licenses Fi360’s Fiduciary Score as one of several fund selection criteria for use within the GoalPath Fi360 Funds. Fi360 serves as a data provider to GoalPath and is not a sub-advisor to the funds.

What is the Fi360 Fiduciary Score?

The Fi360 Fiduciary Score is a peer percentile ranking of an investment against a set of quantitative due diligence criteria selected to reflect prudent fiduciary management. The Fi360 Fiduciary Score is calculated on a monthly basis for investments with at least a three-year history. The score is calculated for open-end mutual funds, exchange-traded funds, collective investment trust funds, and group retirement plan annuities.

What market need does the GoalPath Fi360 relationship address?

Since fiduciary compliance has hit the mainstream, many market participants have expressed concern about an advisors’ ability to apply a fiduciary standard of care to all clients based on the time required to appropriately review and rebalance portfolios.

Including Fi360 Scores as a criteria within GoalPath’s fund selection process ‘builds-in’ scalable fiduciary reviews and rebalancing for advisors who select these strategies.

This is a great example of technology driving efficiencies in fiduciary account management, right?

No. While advisors can delegate certain fiduciary responsibilities, they can’t abdicate them. Usage of GoalPath’s strategies that leverage Fi360 Scores should help align portfolio construction and rebalancing with a baseline fiduciary standard, but it’s still prudent for advisors to monitor all investment strategies on a regular basis.

Is Fi360 serving as a sub-advisor on strategies created by GoalPath?

No, Fi360 is solely serving as a data provider to GoalPath.

Which GoalPath strategies incorporate Fi360 Scores?

Currently, the 2020 – 2060 GoalPath Fi360 Conservative, Moderate, and Aggressive Funds use Fi360 Scores in their fund selection methodology. See the fact sheets.

Is there an indexed version of this series available as well?

Yes, there is. See the index fund fact sheets.

Fi360 Fund Documents

GoalPath Fi360 Portfolios: Matrix CIF

GoalPath Fi360 Portfolios: Target Date Retirement CITs

GoalPath Fi360 Fund Overview

Get Started